Travelling overseas requires extensive planning irrespective of the travel purpose. Travel medical insurance is an essential part of travelling. Medical emergencies are unexpected and inevitable. Hence, having a financial safety net in the form of travel medical insurance is most crucial to safeguard your journey.

What is travel medical insurance?

Travel medical insurance provides coverage against healthcare expenses that may arise due to sudden illness or health issues or meeting with an accident in a foreign land during the travel. The cost of medical services is extremely expensive across the globe. Hence, it’s wise for every traveller flying abroad to have adequate insurance coverage to extend financial support during any medical emergencies.

How is travel medical insurance different from any other types of insurance?

Travel medical insurance holds a special place in every frequent traveller’s mind. There is not much difference between travel medical insurance plans and travel insurance plans. Having provisions for medical emergencies is a priority. Travel medical insurance plans are specifically crafted to address healthcare needs of travellers. Let’s learn how different it is from other travel insurance plans.

- The primary difference is, travel medical insurance plan focuses more on providing healthcare coverage than travel-related coverages. Travel insurance plans also cover medical expenses but mainly cover trip related issues such as loss of baggage, trip cancellation, flight delay and loss of documents etc.

- Travel medical insurance plans are issued for the tenure longer than that of regular travel insurance plans

- Travel medical insurance plans are priced based on the age, medical history and trip duration of the traveller. Regular travel insurance plans that cover many other things like flight cancellation, trip cancellation, delay etc is mainly based on the cost of the trip. Hence, travel medical insurance plans are relatively economical than regular travel insurance plans.

How to avail travel medical insurance?

As travel and health insurance industry are booming in India, there are numerous plans available for travellers. Choosing the right one may take some time. You may need to do research on benefits provides, features included in the policy and compare the cost. After analysing on cost and benefit basis, you can easily purchase travel medical insurance plans online within few clicks. Insurance technology firms provide great platform for comparison of a wide array of travel health plans from various insurance companies. Once you select the right plan to purchase online, your major work is done.

Following are the steps to follow:

- Enter your personal details and any other relevant information as required for filling up the insurance application.

- Mention the coverage requirement and medical history correctly.

- Submit documents, if any required.

- Make a payment online and proceed to complete the buying process.

Documents required for buying travel medical insurance

Travel medical insurance plans can be purchased online instantly without any paperwork involved. However, you need to keep your personal details, health history and travel details ready to make an application.

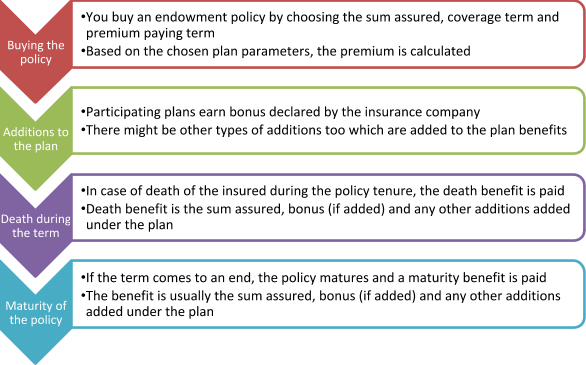

Types of travel medical insurance plans

There are various types of medical travel insurance plans are available in India. Travel medical insurance plans are categorised as follows:

- Individual travel medical insurance plan:

The plan provides coverage to an insured individual for any unforeseen medical emergencies that may arise during the travel period. Travel medical insurance plan issued to an individual will also cover other travel-related risks, however, concentrates primarily on healthcare. - Family travel medical insurance plan:

In case you are travelling with the family, family travel medical insurance plan can be availed to protect the entire family within a single policy. Basically, it’s a policy that covers all the members of the family with one sum assured which can be utilised by any insured member of the family during health emergencies in the travel period. The plan also covers family against various travel risks. - Annual travel medical insurance plan:

Annual travel medical insurance plans are specifically designed and suitable for travellers who travel multiple times during the year. Hence, annual policy provides year-round protection against any health contingencies, dental problems, evacuation requirements that may arise during the travel. Other travel-related risks such as delay and cancellation will be included in the policy - Senior citizen travel medical insurance plan:

Health is a major concern for senior citizen travellers. Travel medical insurance plan exclusively designed for senior citizens provide financial security against various unforeseen health conditions during the travel. The policy will also cover other travel-related risks - Student travel medical insurance plan:

These plans are designed to address the unique needs of students travelling abroad for studies. The policy covers hospital and medical expenses during the policy period along with other non-medical expenses. When it comes to students, the coverage provided is extensive.

Medical cover provided under travel medical insurance plans

Following are the medical coverage offered under travel medical insurance plans:

- Medical expenses cover:

Hospitalisation/ medical expenses incurred for an illness contracted or injuries sustained on a trip during the period of insurance. Some policies will cover pre and post hospitalisation expenses depending on the terms and conditions of the policy. - Medical evacuation:

The travel medical insurance policy will cover the cost incurred on evacuation services, transportation expenses or ambulance charges reasonably incurred to take insured to the hospital is covered. - Additional benefits:

Some of the travel medical insurance policies may include additional benefits such as daily cash allowance for hospitalisation, repatriation of remains and pre-existing illnesses extension etc. Some benefits can be added optionally at an extra cost of the premium.

However, these policies also cover other non-medical expenses such as trip interruption and cancellation, burglary, missed flight, compassionate visit, trip delay and emergency interruption etc.

Best #5 travel medical insurance plans:

There are a variety of travel medical insurance plans available with various unique features and coverage. You can compare and choose the best suitable plan based on your coverage requirement, affordability and benefits requirements. We have listed down some of the best travel medical plans available in the market

| Plan Name | Coverage Details |

|

|

|

|

|

|

|

|

|

|

Frequently Asked Question (FAQs)

- Is travel medical insurance mandatory?

No. Though travel medical insurance is an important necessity, it’s not mandatory. However, some of the countries such as Australian countries and Schengen countries have made it mandatory for visiting travellers. - Can travel medical insurance plans be extended?

Yes. Travel medical insurance plans can be extended in case your travel is extended for any reason. - Does travel medical insurance plans cover dental treatment expenses?

Yes. Dental treatments availed due to an injury or an accident are covered under travel medical insurance plans. - How am I covered under the travel medical insurance plan for accidental injuries/disabilities?

In case you meet with an accident during travel and that results in injury or disability, your travel medical insurance plan will compensate for the loss and for medical treatments needed up to the limit specified in the policy. - Does travel medical insurance plan offers the cashless facility for medical cover?

Yes. Medical expenses under the plan for sudden illnesses and injuries are covered in a cashless manner. There are also daily hospital allowances provided under some of the travel medical insurance policies.