The Coronavirus pandemic has become a global threat and it is claiming an increasing number of lives world over. Even in India, the number of infected individuals has crossed the 2.5 lakh mark (as on 8th June 2020) and the numbers are expected to increase in future. To curb the spread of the disease, the Indian Government took some bold measures like initiating a nationwide lockdown. Moreover, to prevent community spread and to educate individuals about the safety protocols for battling the pandemic, the Government also introduced the Aarogya Setu mobile application. Let’s understand what this application is all about –

What is the Aarogya Setu app?

Aarogya Setu is a mobile application developed by the Indian Government. The application can be downloaded on any Smartphone and can be used to track the spread of Coronavirus, learn about prevention measures, assess the health risk of an individual and to find hotspots near one’s location. Thus, this is a multifaceted app which helps individuals keep themselves safe from Coronavirus infection.

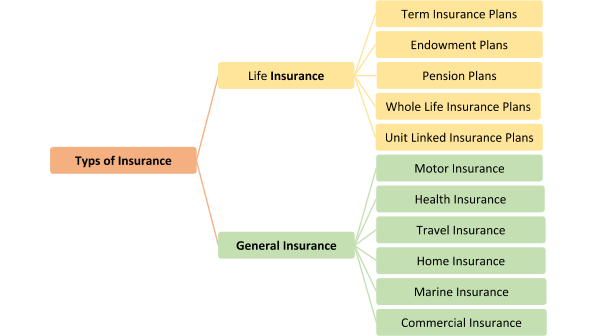

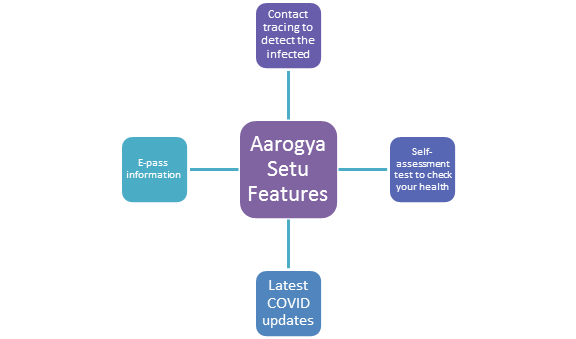

Features of the Aarogya Setu application

The Aarogya Setu mobile application is a digital initiative by the Government to connect with the population and educate them about the possible spread of infection. The salient features of the app are as follows –

- The application works on the principle of contact tracing to find out the number of people you have come in contact with and if anyone among them presents a risk of infection

- There is a self-assessment test on the application which is based on the guidelines issued by ICMR (Indian Council of Medical Research)

- All latest COVID updates can be found on the application

- If you have applied for an e-pass and you have received it, the information would be available on the application. You can, therefore, use the application to keep the pass at your fingertips

How does the Aarogya Setu application work?

The Aarogya Setu application uses your phone’s Bluetooth and Location services to work. When you come in contact with an individual who also has the application installed on his/her phone, the application detects the digital signature of the individual’s application and there is an exchange of information of this contact. The information includes the time, date and location of the contact. Thereafter, if any of you test positive for COVID, the application would calculate the risk of infection of the other person. This calculation is done considering how recent was the contact and how proximate you were on such contact. If there is a threat of infection, the application updates you about the same through a notification. The Government is also informed allowing it to take measures to contain the spread of infection by providing the necessary medical care.

How to download Aarogya Setu app?

It is quite simple to download and use the Aarogya Setu app. The relevant steps are listed below –

- If you have an Android phone, visit the Play Store and search for the Aarogya Setu app. For iPhone users, the app would be available for download in the Apple Store.

- Install the application on your Smartphone

- Once the application opens, you would be asked to choose your preferred language. There are 12 language options including English, Hindi and other regional languages

- The app helps in tracking your proximity to a COVID positive individual in your area. You, therefore, have to switch on the ‘Location’ service (GPS) and Bluetooth on your Smartphone.

How to use Aarogya Setu app?

Once you have downloaded the application, using it is quite easy. You would, first, have to register yourself before you start using the Aarogya Setu app. The process of registration and ways to use the app are as follows –

- After you have selected the preferred language and read through the app’s features, you would have to choose ‘Register Now’

- The permission for turning on your Bluetooth would be asked which you should agree to

- The terms of service of the application would be shown and you should click on ‘I Agree’

- Enter in your mobile number and an OTP would be sent to your number

- The OTP would be auto-filled and you would have to provide your personal details. These details would include your gender, full name, age, profession, your travel history and whether you would volunteer in an emergency

- Once the details are provided, click on ‘Submit’

- Then you would be asked of your recent health status. There would be a 20-second self-assessment test which you can take immediately or at a later time

- You can, then, view the home page of the application wherein you would get updates about the number of users in your area and possible hotspots. You can also check your risk of infection and read up on measures to prevent yourself from infection.

Self-assessment health check-up on the app

One of the best features of the Aarogya Setu mobile application is the self-assessment health check-up which allows you to assess your current health condition and find out whether you face a risk of COVID infection or not. This assessment has been designed on the guidelines of the ICMR. The test asks you several questions to determine whether you face any danger of infection or not. The questions include the following –

- Whether you are suffering from specific symptoms like cough, fever and difficulty in breathing or nothing

- Whether you have had any pre-existing illness like diabetes, hypertension, lung disease or heart disease

- Your international travel history within the last 28-45 days

- Whether you have interacted with a COVID positive individual or not or whether you are a healthcare worker or not

When you answer the questions successfully, your infection risk would be calculated and shown. You would also be advised on the course of action that you should take based on your infection risk.

Benefits of the Aarogya Setu application

The Government of India took a very good step in launching the Aarogya Setu application and promoting its use. The application is quite beneficial in the following respects –

- The self-assessment test lays your infection worries to rest by showing you your infection risk. Even if you are in a hotspot, you can take the assessment test and check whether you are exposed to the risk of infection or not.

- Since the application tracks individuals near you who can be infected, it informs you of positive cases so that you can eliminate contact with the infected person in your area. Moreover, if you have come in contact with an infected individual, the application advises you on self-quarantine to prevent the spread of the virus.

- You can check the list of laboratories near you for COVID testing through the app

- The application is integrated with e-pass if you have availed the same to travel during the lockdown. The e-pass details can, thus, be stored on your mobile and can be accessed anytime that you need

- The application sends you regular notifications about Coronavirus spread near you. This helps you remain updated about the disease so that you can prevent a possible infection

- If you are COVID positive and you need help, you can contact the COVID helpline number directly from the application and get medical help without having to step out from your house

The Aarogya Setu app is a good initiative by the Indian Government which is aimed to track and break the chain of the spread of the virus. You can use the application to track the number of cases in your proximity so that you can take the necessary steps to avoid contracting the virus.

Frequently Asked Questions

- Is the result of the self-assessment test shared with the Government?The self-assessment test assesses the risk of infection that you face. If you face a moderate or high risk of infection, the application would ask for your consent to share the results with the Health Ministry. Only if you allow would your result be shared with the Government. It is recommended that in high-risk cases, the results should be shared with the Government so that necessary medical assistance can be arranged.

- How does the application notify about a COVID positive individual?If an individual has taken a COVID test and the result is positive, the information is shared with ICMR. ICMR, then, shares the list of positive patients with the Aarogya Setu application server. If the patient has the Aarogya Setu application installed on his/her mobile phone, it is updated on the application and the patient’s contact tracing is done to find out about individuals who might have come in contact with him/her.

- Is my personal information shared on the application safe?Yes, your personal information is always kept safe and the application does not share it with any third party.