Ever since the COVID vaccine was launched in January 2021, a new ray of hope has emerged. Though the infection is still not under control, the hope of a vaccine has created a positive environment in the country. Now, with the vaccine available for all adults, the Government of India has undertaken a massive vaccine drive. So, here’s everything that you need to know about the COVID vaccine.

Types of vaccines

Currently, two COVID vaccines have been authorized by the Central Drugs Standard Control Organization (CDSCO) for use in India. These are as follows –

- Covishield ® which is AstraZeneca’s vaccine developed by the Serum Institute of India

- Covaxin ® which has been manufactured by Bharat Biotech Limited

Development of COVID vaccines

Ever since the COVID pandemic struck, India has been involved in launching a vaccine as soon as possible. As such, the two vaccines have been developed. The development of vaccines has been done in different phases which are explained below-

- Pre-clinical –

vaccine is tested in lab animals - Phase 1 –

Clinical trial in limited participants to determine the right dosage - Phase 2 –

Clinical trial in a few hundred participants to check whether the vaccine generates an immune response - Phase 3 –

Clinical trial in thousands of participants over 1-2 years

Both the vaccines have completed the first two phases of trials and Covishield has completed the third phase trial in the UK and the bridging trial in India.

Administration of COVID vaccine – the timeline

The Government of India introduced the vaccination in a phased manner. The vaccination drive started with frontline and healthcare workers who were at the highest risk of contracting the infection. Then it was percolated down in descending order for individuals with the highest risk of COVID.

Here’s the timeline of how the vaccine drive was introduced by the Government of India in phases –

- 16th January 2021

- Both the vaccines were launched

- They were available for healthcare workers and frontline workers

- 1st March 2021

- Persons aged 60+ eligible for the vaccine

- Persons aged between 45 and 59 eligible if they have co-morbidities

- 1st April 2021

- Vaccine available for those who are aged 45+ years

- 1st May 2021

- Individuals aged 18+ become eligible for vaccination

Registration for vaccination

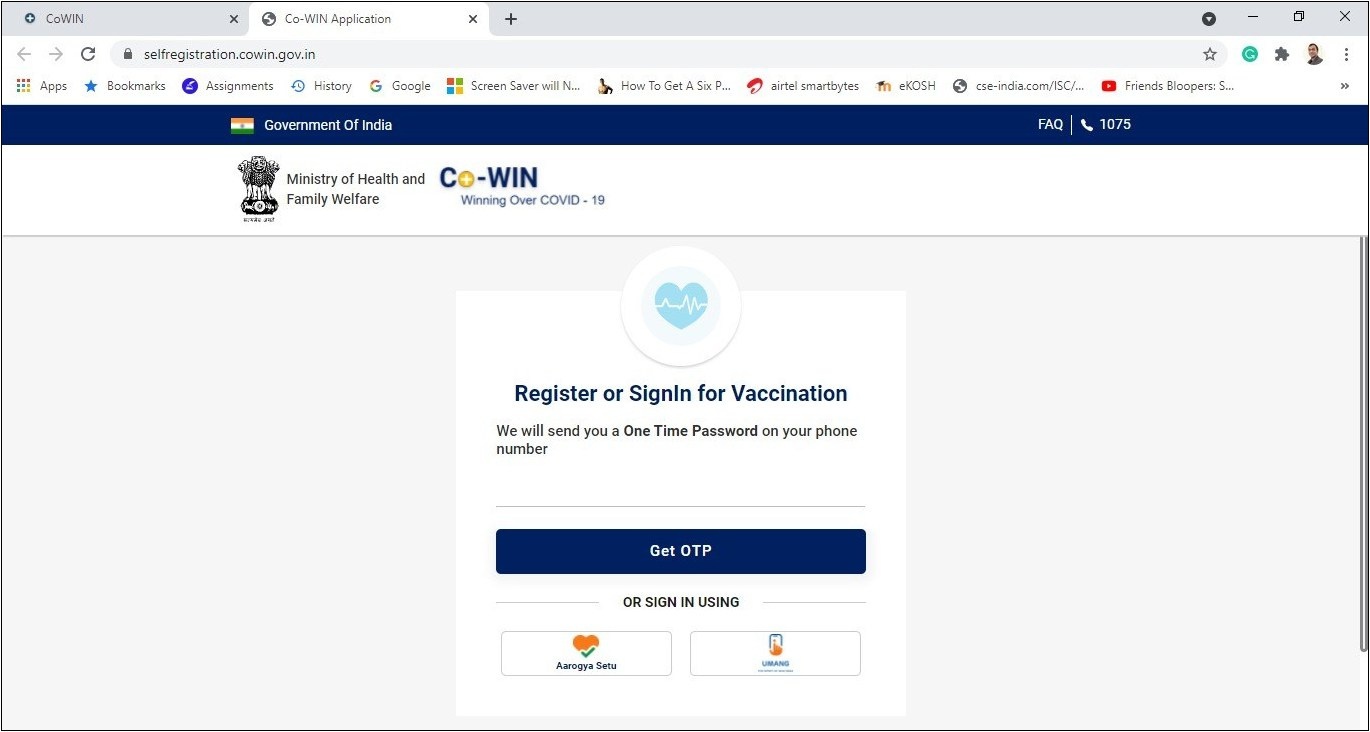

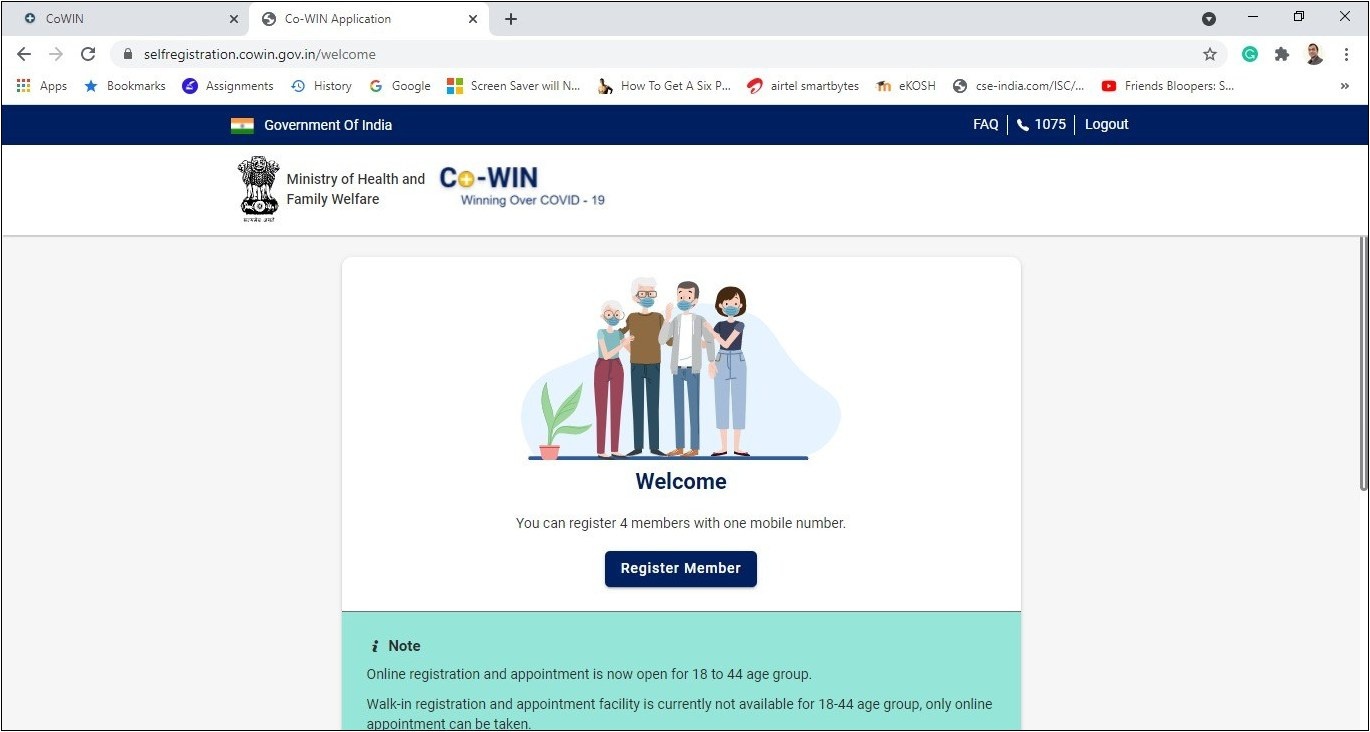

If you or any of your family members are eligible for availing of the vaccine, you would have to register yourself for the same. Registration is compulsory either in advance or on the spot. You can register online on the Co-WIN portal developed by the Government or on the COWIN or Aarogya Setu mobile applications.

Relevant Links: CO-WIN website

Download the Arogya Setu App from PlayStore

Or simply scan to download Arogya Setu Mobile App

Benefits of registration

Here are some of the benefits of registering for the COVID vaccination –

- You can enrol yourself and your family members for the vaccination

- You can fix the time for availing of vaccination

- You can choose the vaccination centre wherein you want to get vaccinated

- You can also reschedule the vaccination date if you miss or are unable to visit the centre on the scheduled date

- Your vaccination certificate would be shared with you when you are registered

Vaccination details

- Vaccines would be given at both Government health centres and private health facilities. These are called COVID Vaccination Centres (CVC).

- In the case of vaccination in private CVCs, you have to register yourself prior to vaccination.

- In the case of vaccination in Government health centres, a part of the slots would be reserved for online registration. However, the rest of the slots would allow walk-in or on-site registrations and appointments.

- The appointment slots for any date would close at 12 pm a day before such date.

The process of registration

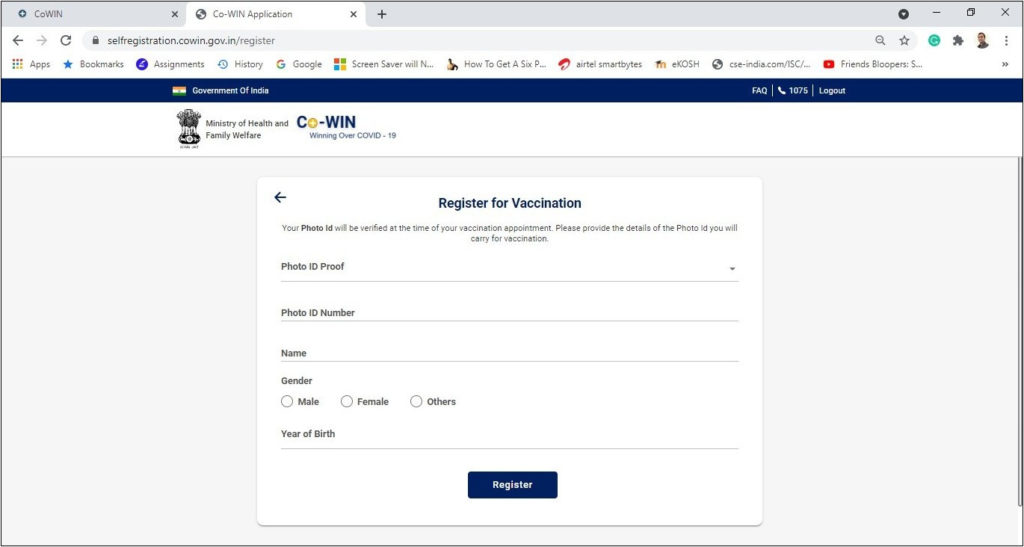

Here is a step-by-step guide to register yourself and/or your family members on the COWIN portal for vaccination –

- Visit www.cowin.gov.in and click on ‘Register / Sign In Yourself’

- A new page would open wherein you would have to provide your mobile number for getting an OTP. Alternatively, you can sign in using the Arogya Setu or Umang application.

- Enter the OTP received for verification and to proceed with the registration

- A new ‘Registration for Vaccination’ page would open containing the fields which you need to fill with your information.

- The information that should be provided includes –

- The photo identity proof that you are submitting for registration

- Number of the identity proof

- Name

- Gender

- Birth year as in the identity proof

- After the details are provided, click on ‘Register’ and you would be able to register yourself successfully.

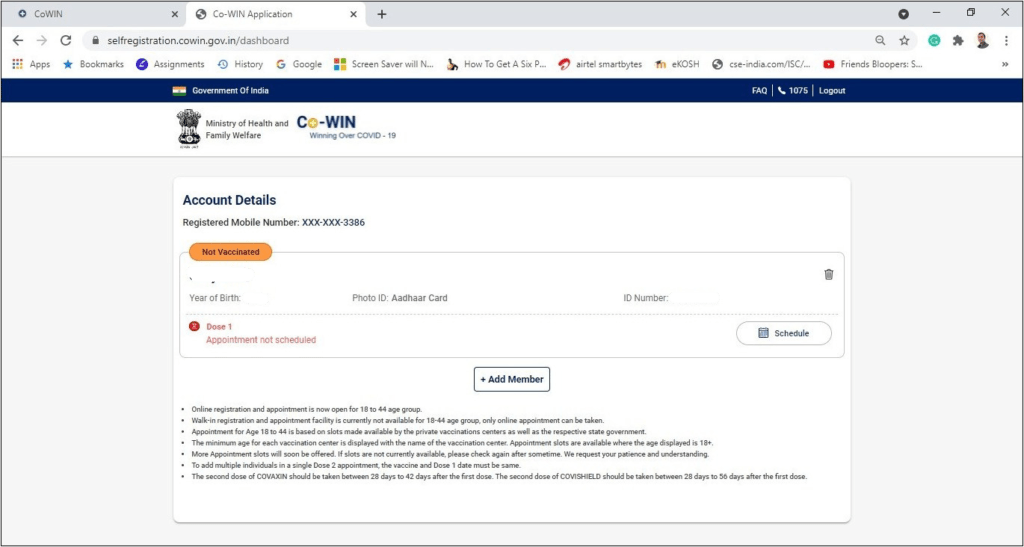

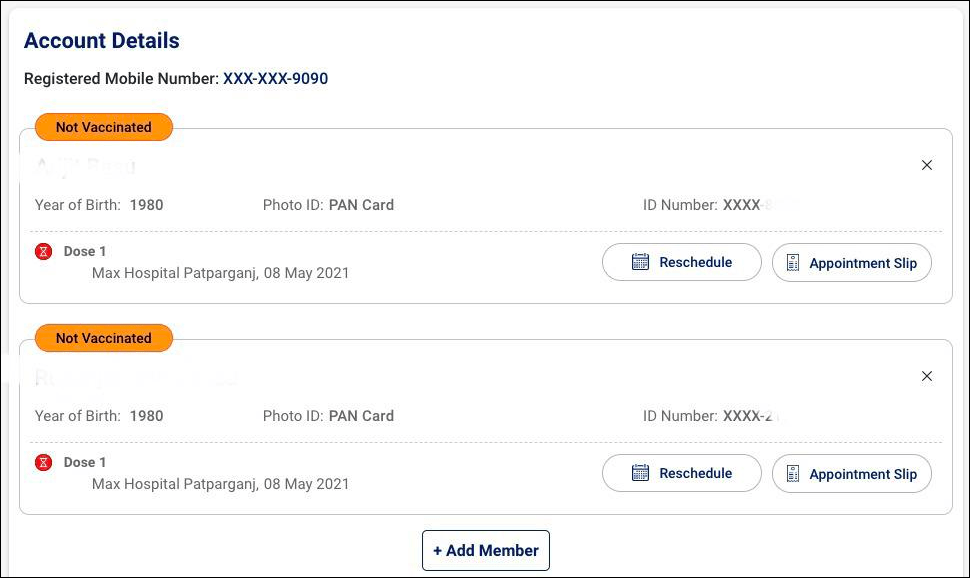

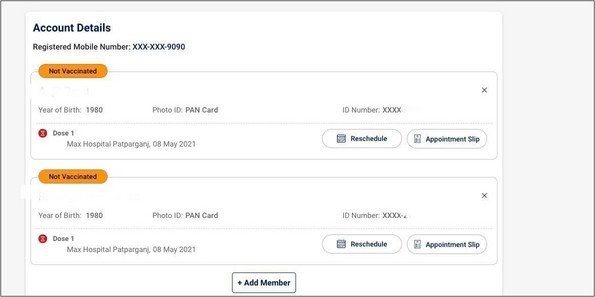

- You can, then, go into your account and check your details. You can also add up to four additional family members under a single registration

- To add members, click on ‘Add More’ on your ‘Account Details’ page. Provide the information of the member (s) and the member (s) would be added

Appointment for vaccination

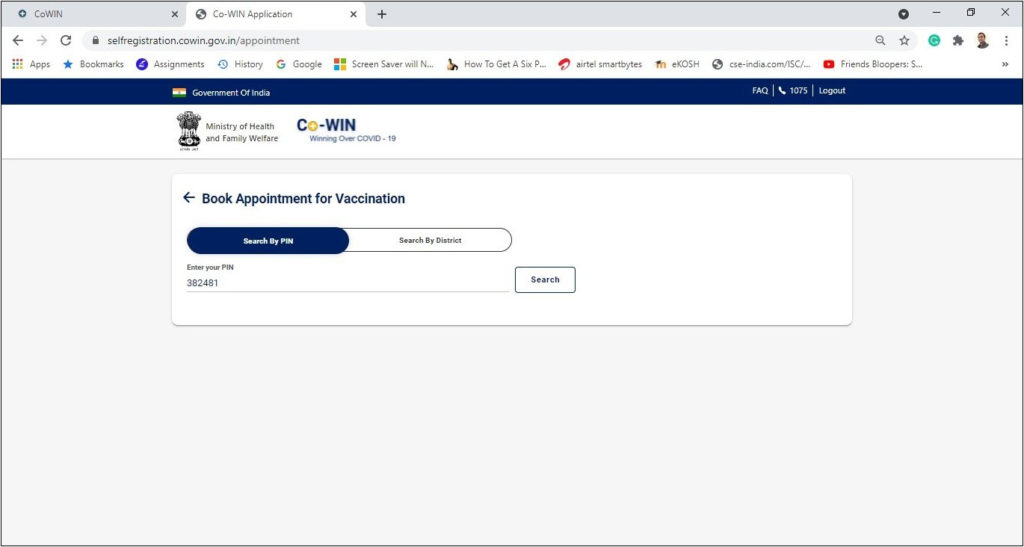

Once the registration process is complete, you can fix your appointment for vaccination. It can be done using the following steps –

- On the ‘Account Details’ page, click on the ‘Schedule’ button next to the registered name to schedule an appointment.

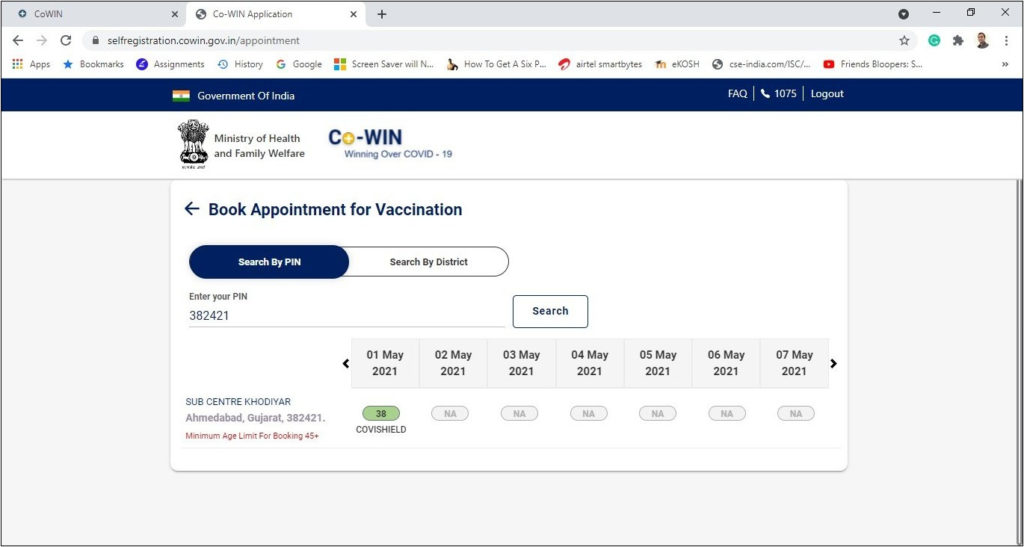

- You need to enter your PIN code or your district name to find the CVCs wherein vaccinations are available.

- When you choose any centre, the available slots would be displayed for a particular date. It would also show the capacity of the respective slot.

- Choose a relevant and suitable date and fix your appointment

- After you choose any slot, click on ‘Book’. An ‘Appointment Confirmation’ page would open that would show your name, date and time of appointment.

- Click on ‘Confirm’ to confirm the details and your appointment would be booked.

- You would, then, be able to see an ‘Appointment Successful’ page such as

Then you can download the Appointment Slip as well. The appointment slip has the details of the centre, date and time along with your name and your ID document with a registration ID.

The confirmation of your appointment is shared with you through an SMS that states the date, time and the centre of vaccination. Once you take the vaccination on the scheduled date, another date is automatically allotted for the second dose.

Rescheduling your appointment

If you want, you can reschedule your appointment any time before the appointed day. To do so, log in to the COWIN portal with your mobile number. Verify your account with an OTP. Thereafter, here are the steps for rescheduling the appointment –

- Go into the ‘Account Details’ and click on the calendar icon to reschedule your appointment

- Choose a new date and then click ‘Book’ to reschedule

- Click on ‘Confirm’ and verify the date and appointment time

- A new page would open showing that your appointment is rescheduled

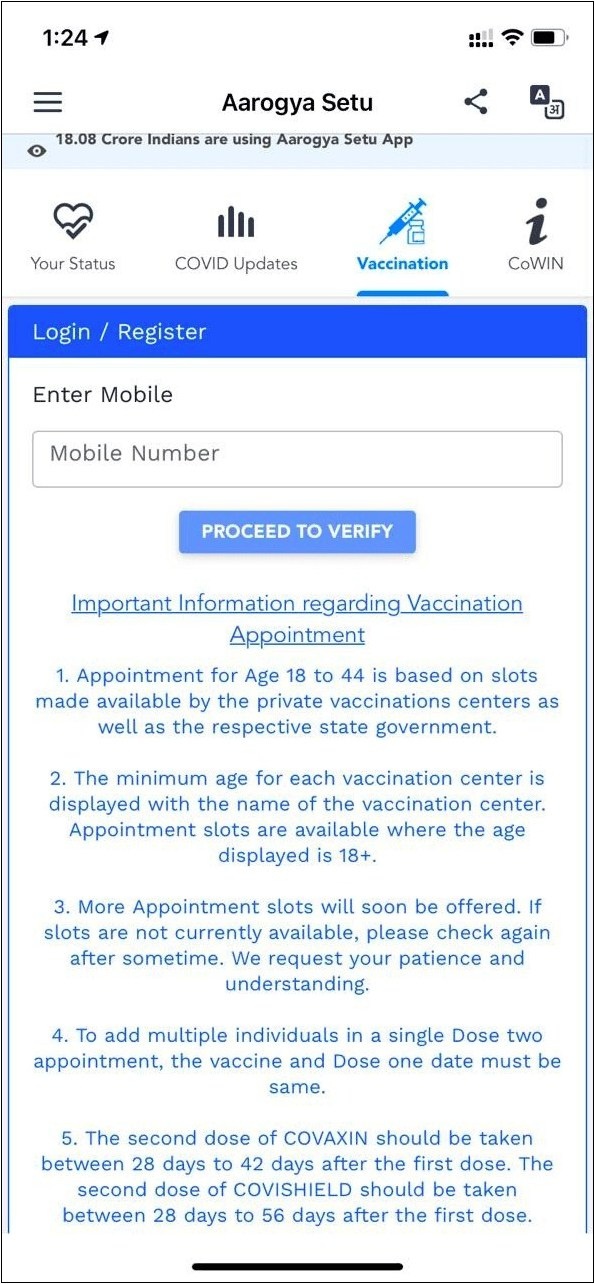

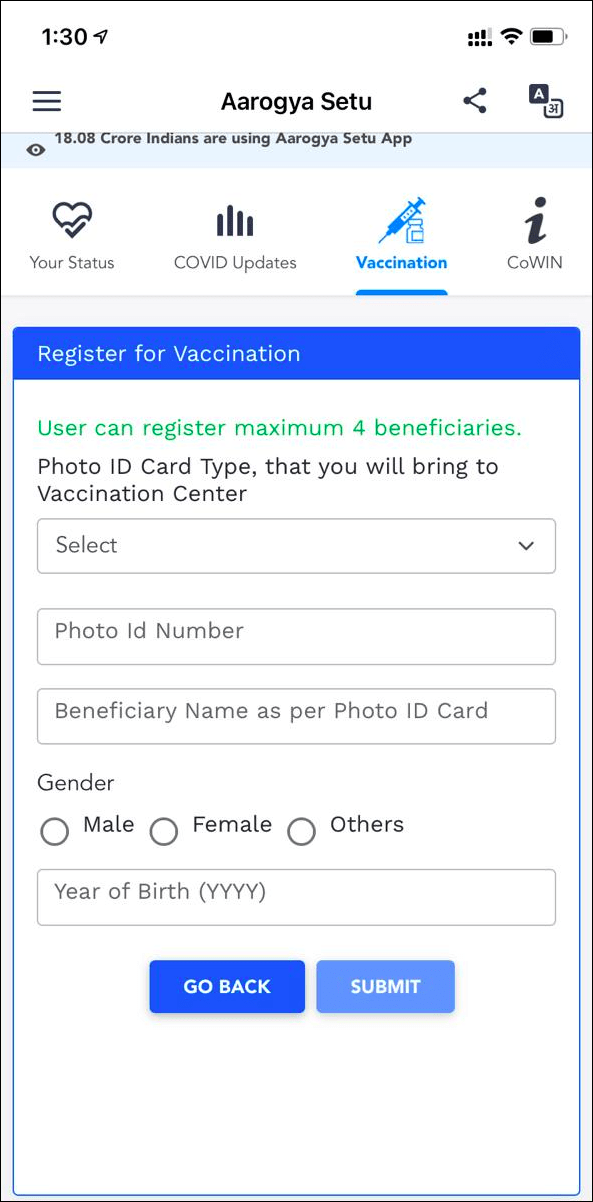

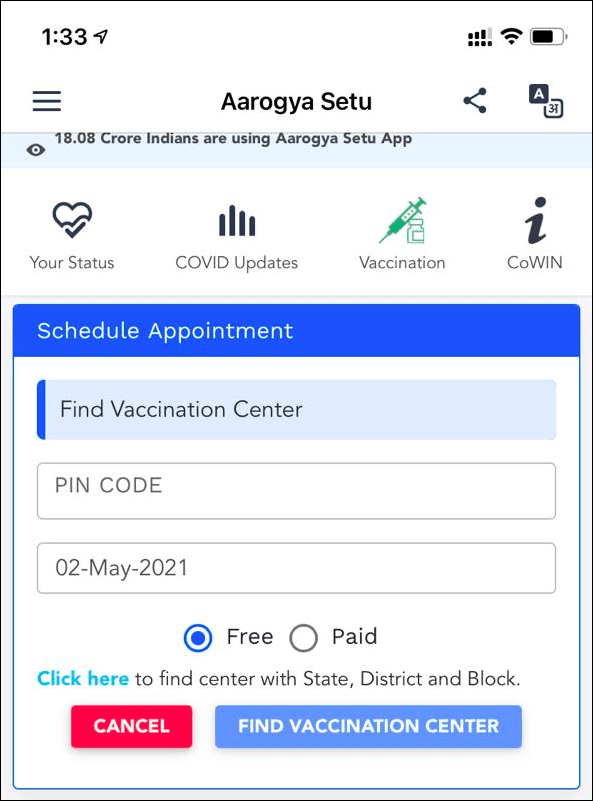

Booking the appointment through the Arogya Setu App

- You need to log in with your phone number and OTP

- You can register up to 4 people with the ID, Photo ID Number, Beneficiary Name, Gender and Year of Birth

- Once the registration is done, you need to schedule the appointment. Click on the same and schedule for vaccination

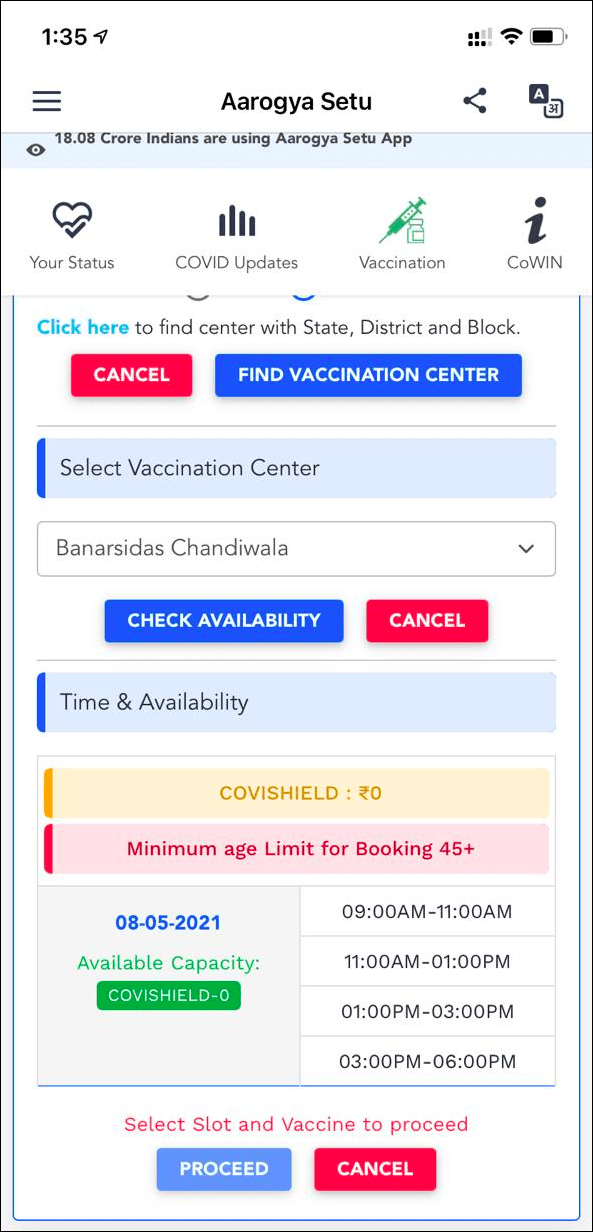

- You can search by Pincode and Date to find the nearby vaccination centre

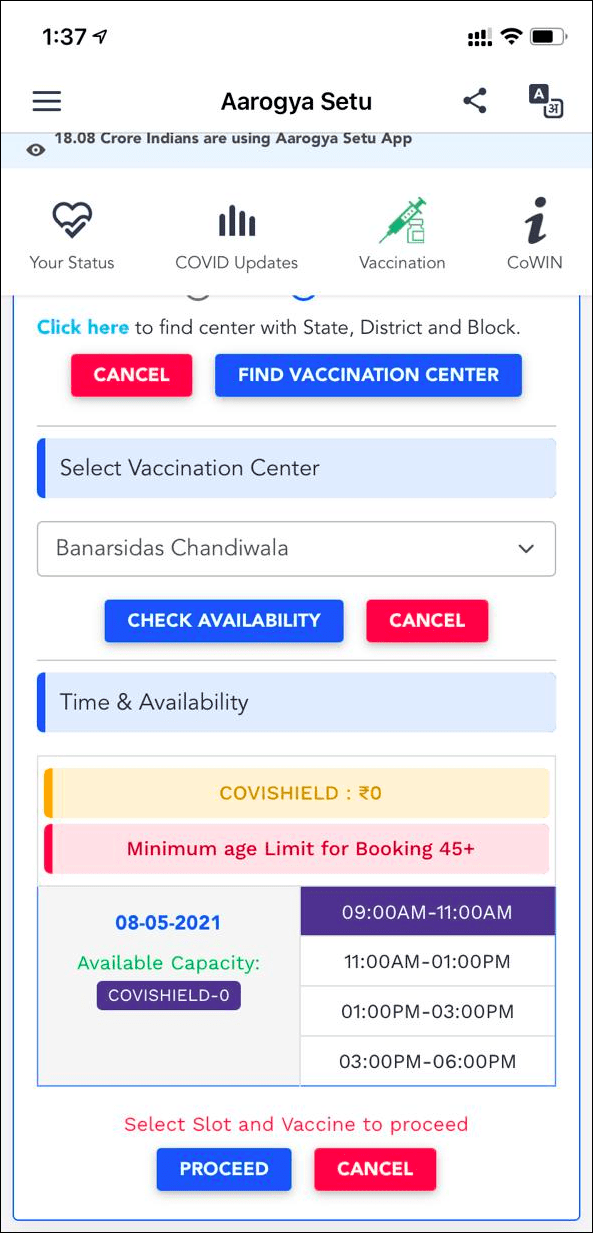

- Check and confirm the time and availability of the vaccination

- Confirm the time slot and then click proceed

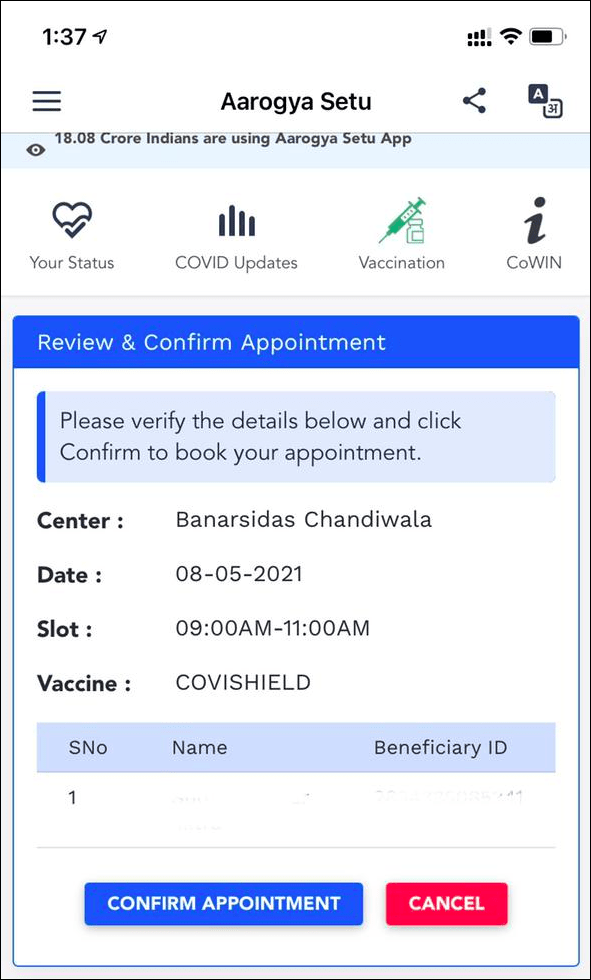

- Then the appointment details would reflect and you need to confirm the appointment

- The appointment details would reflect in your App.

Documents needed for vaccination

You need to provide identity proof that would be required for registering for vaccination. Some of the acceptable identity proofs include the following –

- Acceptable identity proofs:

- Aadhaar card

- Driving License

- PAN Card

- Passport

- Voter ID Card

- Bank passbook

- MNREGA Job Card

- Health insurance Smart Card that has been issued under the scheme launched by the Ministry of Labour

- Any official identity card which is issued to MPs, MLAs, or MLCs

- Any pension-related document

- A service identity card issued by the Government to Government employees

Besides these, you can also provide the following as identity proofs –

What is Comorbidity?

If multiple health conditions are present in a person, it is known as comorbidity. So, if you have hypertension or diabetes, etc. and then have Covid-19, then hypertension or diabetes are considered as comorbidities along with Covid-19.

Furthermore, if you have any comorbidity, you would have to carry a certificate of comorbidity, filled and signed by a registered medical practitioner. The certificate of comorbidity should be filled in the format provided in the link: Certificate of comorbidity.

Once the vaccination is done, you would get a digital certificate certifying the completion of the vaccination. A provisional certificate would be issued after the first dose and once the second dose is completed, you would get a QR code-based final certificate. You can, then, download the certificate for your use.

Dosage for the vaccine

After the first dose of the Covishield vaccine is taken the second vaccine should be taken within the next four to eight weeks. In the case of the Covaxin vaccine, the second dose should be taken within four to six weeks after the first dosage.

In case of people diagnosed or suspected of COVID infection are required to wait for 14 days for taking the vaccine. On the other hand, if you have recovered from COVID you should wait for at least four to eight weeks to get the vaccination.

The body takes about two to three weeks to develop an adequate immune response to COVID after both the doses of the vaccine are taken.

Side effects of the vaccine

Like other vaccines, Covishield and Covaxin have side effects too. These include the following –

- Mild fever

- Pain or irritation at the site of the injection

- Mild fever

- Irritability

To deal with these side effects, you can take paracetamol.

Cost of the vaccine

The cost of COVID vaccines is different for the different types of medicines. Moreover, the cost also varies depending on the COVID Vaccination Centres (CVCs) that you choose. Here are the costs –

- For individuals aged between 18 and 45 years

- Covishield Vaccine – For State Government INR 400 and for private hospitals INR 600

- Covaxin Vaccine – For State Government INR 600 and for private hospitals INR 1200

However, many State Governments are offering free vaccines at Government health centres. These States include the following –

- Kerala

- Haryana

- Madhya Pradesh

- Goa

- Jammu and Kashmir

- Telangana

- Uttar Pradesh

- Bihar

- West Bengal

- Sikkim

- Assam

- Tamil Nadu

- Andhra Pradesh

- Chattisgarh

- Maharashtra

- For others

Healthcare workers, frontline workers and individuals aged beyond 45 years can get free vaccinations at Government healthcare centres.

Source: Economic Times & Bloombergquint

So, understand everything about the COVID vaccines and register yourself for the vaccination if you are eligible for the same.