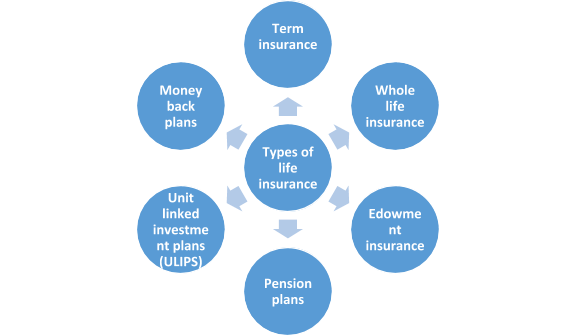

Life insurance is a long-term financial product. Though you may buy any LIC insurance or investment policy with a specific purpose to meet a long-term need, your investment perspective can change over the years of time. Sometimes you may have to exit from your long-term LIC investment for various reasons such as a change in your requirement, sudden personal economic hardship or the product is a misfit for your current investment portfolio. Whatever may be the reason, Life Insurance Corporation allows you to surrender your policy mid-way with certain conditions attached to it in specific to each policy.

With the convenient option of allowing policyholders to surrender policies, insurance plans from LIC not only secure your future but also help in emergencies. Browse through the top insurance plans from LIC today via a few simple steps by clicking here.

Are you planning to surrender your LIC policy? But, are you aware of the value attached to the cancellation or surrender of the policy? If not, read on to know the surrender value in detail and how to calculate LIC surrender value.

What is the surrender value?

Surrendering the LIC policy means terminating the policy before the date of maturity. As the name implies, surrender value is the amount that is paid by the insurance company on terminating or surrendering the policy.

‘Surrender value’ exists for only those LIC policies that have savings component attached to it. For such savings plus insurance plans, the surrender value will be paid on terminating the policy in return of all the premiums paid by you till the date of surrender. In many cases, depending on the terms and conditions of the policy surrender charges will be levied. The final surrender value payable is determined after deduction of charges if any.

Usually, in most of the traditional LIC investment policies, policy acquires the surrender value after the payment of premium for at least two to three policy years.

Demerits of surrendering LIC policy

It is not advised to surrender a LIC policy since it completely ruins the purpose of opting insurance, however, if you are unable to pay the premium, you can surrender the policy anytime.

- When you surrender your policy, the life cover factors also become unavailable.

- Depending on the terms and conditions, the accumulated bonus on the LIC policy is given. Since surrendering the policy can be counted as a breach of the policy, therefore only a part of the premiums paid is returned.

- If you wish to invest in the same policy a few years later, the premium amount will increase owing to your increased age and risk as well.

- The surrender value will completely become zero if you surrender the policy before the completion of three years.

Types of the surrender value:

There are two types in surrender value – guaranteed surrender value and special surrender value. Higher of the two is paid as ‘surrender value’ at the time of surrender.

What is guaranteed surrender value?

Guaranteed surrender value is the amount that is guaranteed to be paid by the insurance company in case of surrendering the policy during the policy term after the policy acquires a surrender value. Guaranteed surrender value is generally a certain percentage of total premiums paid excluding the additional premiums paid for riders if any. Percentage may vary depending on the policy term and the policy year at which you are surrendering the policy. Percentage or the surrender value factor increases with policy terms. That means percentage applicable will be more as the policy nears maturity.

In most of the policies, along with guaranteed surrender value, the surrender value of vested bonuses will also be paid (if applicable). Based on the policy year of surrender, percentage of vested bonus payable varies.

For example, let’s say you have invested in LIC’s New Jeevan Anand plan for 15 years. Let’s say you are paying a yearly premium of INR 40,000 (net of tax). In case, after the third policy year you wish to surrender, your policy’s guaranteed surrender value will be 30 %( surrender value factor applicable) of total premiums paid. Following will be the guaranteed surrender value:

Guaranteed surrender value = Surrender value factor X Total premiums paid

= 30% X (40,000 X 3) = INR 36,000

Let’s say, vested bonus for your policy at the time of surrender is INR 61,500. Surrender factor applicable for accrued bonuses is 17.66%, then surrender value of vested bonuses will be:

The surrender value of vested bonuses = Applicable surrender factor X Accrued bonuses

= 17.66% X 61,500 = INR 10,861

What is special surrender value?

Special surrender value is the non-guaranteed amount which is either equal to or higher than the guaranteed surrender value. The special surrender value will depend on a number of premium instalments paid by you, policy term and the bonus accrued (if any). Special surrender value is calculated as:

Special surrender value = [{Basic sum assured X Number of premiums paid/ number of premiums payable} + accrued bonuses] X applicable surrender value factor

For example, you have invested in a policy for 20 years for sum assured of INR 10, 00,000. Let’s say you are paying a yearly premium of INR 60,000, which you have paid for 4 years. In the fifth year, you want to surrender the policy for some reason, the following will be special surrender value, assuming that the applicable surrender value factor is 50% and bonus accrued is INR 50,000

Special surrender value = [{10, 00,000X4/20} + 50,000] X50% = INR 1, 25,000

With the steps mentioned above, you can easily calculate the surrender value of your LIC policy. The choice of surrendering your LIC policy mid-way gives you the freedom of investing in any other LIC policy without the worries of the future. Choose the best insurance plans for yourself today!

What is the surrender value factor?

The surrender value factor refers to the percentage of total premiums paid. For the initial three years, the surrender value factor is zero and it keeps increasing from the third year itself. However, the increase varies from company to company depending on a lot of factors like- maturity time, type of policy, completed policy years, and profit fund performance if it is a participating policy.

LIC surrender value calculator

LIC surrender value calculator is an online tool that helps you get the approximate details of your LIC policy surrender. By providing some basic information related to your policy, you can calculate your LIC surrender value instantly.

How to use the surrender value calculator?

Surrender value calculator can be accessed online on the website of an insurance technology firm. All you need to do is input some basic details such as your name, mobile number, plan name, policy term, number of premium instalments paid, premium payment mode, instalment premium and number of years completed by the policy. Once you submit these details, LIC policy surrender value calculator instantly calculates the approximate surrender value and the value will be displayed as a result.

Many other leading insurance providers have also used LIC’s model that allows such flexibility. Top life insurance companies and the features they offer can readily be found here.

It is that simple and easy to know the LIC surrender value! However, it is important to understand the fact that by surrendering the policy you will be devoid of the risk cover that the policy was providing. Evaluate every point before you surrender your policy!